Property Watch – April 2024 UK residential property transactions

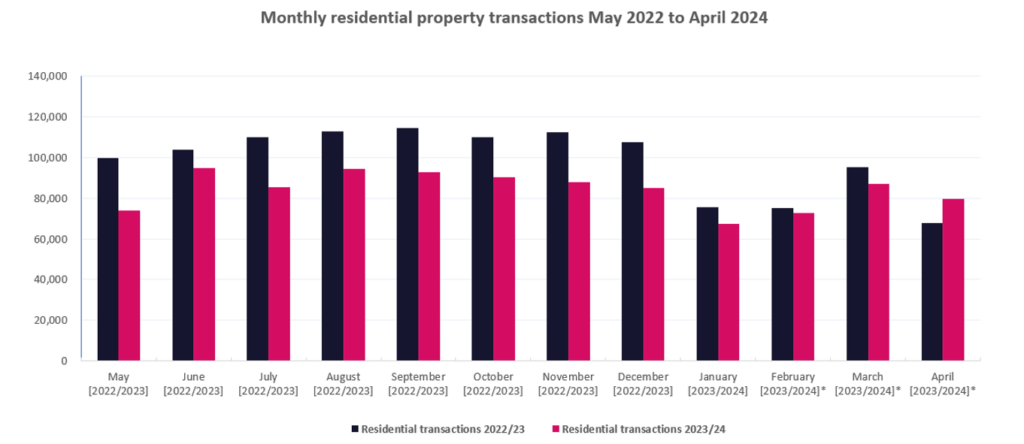

The graph below shows the UK housing market transactions for the year to 30 April 2024 with comparatives for the same period to April 2023, as reported by HMRC through Stamp Duty Land Tax (SDLT) and Scottish/Welsh equivalent reporting.

* February 2024 to April 2024 figures are provisional due to delays in collecting all relevant SDLT/LTT/LBTT reporting.

The graph above shows:

- The April 2024 residential property transactions amounted to 79,590 transactions which were 17.3% up from April 2023 and 8.6% down from March 2024.

- Not shown in the above graph, but the April 2024 transactions were significantly higher than the April 2020 (peak of COVID) transactions by 42,240 transactions (113.1% higher).

- The Bank of England base rate remained at 5.25% throughout April 2024 (4.25% in April 2023).

- The transactions split by location in April 2024 was as follows:

| No. | % | |

| England | 64,610 | 81.2% |

| Scotland | 9,990 | 12.5% |

| Wales | 3,320 | 4.2% |

| Northern Ireland | 1,670 | 2.1% |

| 79,590 | 100.0% |

Key points to note:

- The March 2024 transactions in the above graph are 70 higher than those reported in our March 2024 issue of this circular (which can be viewed here: Property Watch – March 2024) this is as a result of more data being collected throughout the last month to support the transaction data reported.

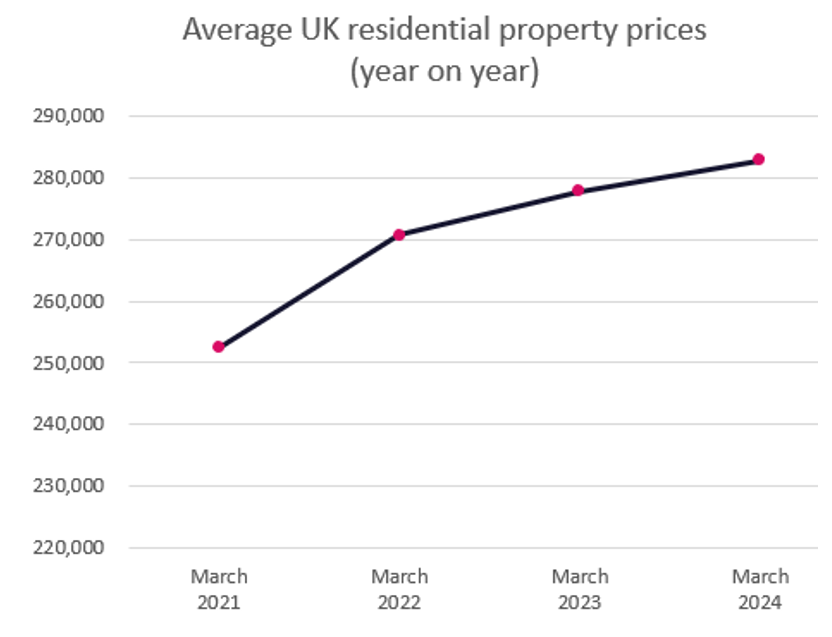

UK residential property transaction prices to March 2024

The latest residential price data, as provided by HM Land Registry to March 2024 (so a month out of sync with the transaction data above) shows that prices were 1.8% up at an average price of £282,776 compared to March 2023’s average of £277,855.

Residential property prices are 12.1% up from March 2021 (during COVID) where the average was £252,355 per the Land Registry data.

Property prices in March 2024 continued to experience a slight increase (0.75% increase) compared to the previous month February’s average price of £280,673.

The graphs below show the change in average residential property transaction values over the past four years and the monthly change in the year to March 2024.

Please note that the above data and trends may not be consistent with published data from other data collectors such as property sites (Rightmove etc.) or the banks and the data is liable to change as the Land Registry receives additional market information.

Ballards LLP’s property team has extensive experience acting for property related businesses and can assist investors, developers and associated trades with all financial property matters including; tax efficient structuring, SDLT planning, Annual Tax on Enveloped Dwellings planning and reporting, and any other financial matters associated with property ownership. We act for all sizes of business.

If you would like to find out how we can help please contact Martin Adams, Tax Partner, at martin.adams@ballardsllp.com or on 01905 794 504.

To view past editions of this circular and other topical tax and business insights please visit our insights page.

Chi Duong, a Tax Associate at Ballards LLP, assisted in the preparation of this article.

Contains HM Revenue & Customs © Crown copyright data.

Contains HM Land Registry data © Crown copyright and database right 2020. This data is licensed under the Open Government Licence v3.0.

Disclaimer (as of 06/06/2024): This article has been prepared for information purposes only as of the stated date. The information provided may not be relevant or accurate for any other date. Formal professional advice is strongly recommended before making decisions on the topics discussed in this release. No responsibility for any loss to any person acting, or not acting, as a result of this release can be accepted by us, or any person affiliated with us.