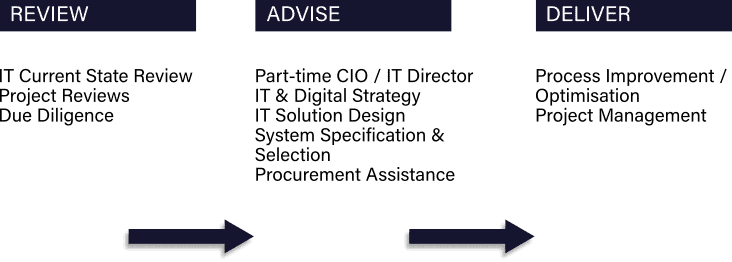

IT & Digital Transformation Services

Our IT & Digital Transformation consultancy is brimming with highly skilled IT and Digital Transformation consultants with real-life, industry based experience of developing IT & Digital Transformation Strategies, conducting detailed technology reviews, selecting and procuring IT systems and experts at implementing new IT systems.

We provide independent and impartial IT & Digital Transformation consultancy services, aimed at supporting clients wherever they may be in their transformation journey.

IT Current State Review

The IT Current State Review is designed to deliver an independent and impartial review of the IT function. The review maps out the IT system landscape, 3rd party IT supplier relationships, underlying IT infrastructure and key data flows. Our expert consultants analyse the information gathered, comparing to best practice and similar businesses, to identify gaps, key risks and opportunities. The output is clear score card report along with a set of prioritised, real-life, actionable recommendations.

Benefit – The independent review ensures the business is better equipped to understand how their IT function aligns to the business needs and where the focus should be to reduce cost and risk or to gain efficiencies from IT improvements.

CHECK OUT A CASE STUDY (RISILIENCE)

IT Project Reviews

A common concern among business owners is how effective internal projects are being managed and if they are going to achieve the original business case aims. We can provide an independent review that analyses the practices and methods being used on key projects, while also providing a health check on any in-flight projects along with any remedial actions if required.

Benefit – An IT project review provides a clarity of understanding on the current status of a project and if it is on track to deliver against success. It enables businesses to make informed decisions to help ensure projects deliver the anticipated benefits, while reducing the risk of over run and unexpected additional costs.

Part-time CIO / IT Director

A commercially focussed Chief Information Officer (CIO) or IT Director ensures alignment between the IT function / capability and the wider business strategy / vision. Ensuring the correct IT systems and providers are selected and correctly managed to drive efficiencies and business improvements. They represent IT at a board level and are fundamental in defining IT governance, whilst managing and mitigating IT risk. This type of resource is costly to employ, with many businesses not having the budget or need for a full-time CIO / IT Director. We can provide part-time CIO / IT Director expertise on a scheduled or adhoc tactical basis.

Benefit – Access to an experienced CIO / IT Director who can reduce your organisational risk, ensuring your IT capabilities can support your business without the cost and commitment of a full time position.

CHECK OUT A CASE STUDY (COVENTRY AND RUGBY GP ALLIANCE)

CHECK OUT A CASE STUDY (RISILIENCE)

IT & Digital Transformation Strategy

An IT & Digital strategy focuses on using technology to improve business performance. It specifies the direction a business should take to create new competitive advantages with technology, as well as the tactics it will use to achieve these changes. We work with our clients to understand their business strategy and ensure that an IT & Digital strategy is developed to support it.

Benefit – Development of an IT & Digital Transformation strategy will ensure your technology plans and investments are aligned to delivering the needs of your current and future business.

IT Solution Design

Businesses often have a specific requirement to achieve i.e “We want to start selling our products online”, “We wish to expand into a new territory”, “A new disrupter has entered the marketplace and we need to compete”, but are unsure of the best and most cost effective IT solution to support the ambition. We work with our clients to ensure the business’s requirements are investigated, agreed, and documented. Our expert consultants will provide insight into the various solution options, with the pros and cons clearly described. The final output being an independent recommended solution design.

Benefit – Businesses benefit from the in-depth knowledge of our consultants to ensure the various solutions are fully explored, with the resulting independent solution design meeting the business requirements in the most practical and cost effective way.

System Specification & Selection

When it comes to selecting new IT systems there are a vast array of options in the marketplace, each with differing functionality and price points. Selecting the wrong systems can be a costly and time consuming mistake, though this is easily avoided. Our expert team have in-depth knowledge of the IT system marketplace, and following our structured methods we guide our clients through the software selection process to ensure the perfect fit for their business.

Benefit – Save time and effort researching the IT system marketplace, and avoid the costly mistake of selecting the wrong systems. We provide independent impartial advice from experts who have real life experience of selecting and implementing new IT systems.

Procurement Assistance

Negotiating and procuring a new IT system is not a simple process. There are many factors that need to be considered, negotiated and agreed during the procurement process. Our consultants have real-life experience of negotiating and procuring IT systems, with detailed knowledge of typical market prices. We can help our clients through the procurement process to provide assistance on understanding the areas of negotiation and what a solid and fair agreement should cover.

Benefit – Businesses benefit from our experience and marketplace knowledge to help ensure they get a fair deal when procuring new IT systems, resulting in an agreement aligning to the business needs.

Process Improvement / Optimisation

Following Lean Six sigma methodologies, we work with clients to scour through their processes; ferreting out any inefficiencies and implementing improvements. We find and focus on change that drives the largest benefits the quickest and producing measurable results. The methodology can be applied to both manufacturing and office/paper based processes with equal success.

Benefit – This is a benefits led approach, clients can expect: reduced costs, increased efficiencies, decreased WIP and better data and reporting.

Project Management

Any business planning to implement a new IT system, perform an upgrade or carry out a major change can benefit from effective project management. Managing projects following a proven and structured methodology reduces risks, while increasing the likelihood they are delivered on time and to budget. Our certified project management consultants all have real-life experience of delivering complicated IT projects across multiple sectors, following a project management approach using tried and tested methods that reduce risk, while successfully delivering projects in a consistent manner

Benefit – We help ensure projects are delivered on time, to scope and on budget. Businesses gain access to highly experienced project managers, who have real-life experience of successfully delivering complicated projects.

CHECK OUT A CASE STUDY (PROCOMM SITE SERVICES LTD)

CHECK OUT A CASE STUDY (CREATIVE FOLKS LTD)

CHECK OUT A CASE STUDY (INVENTOR-E)

Case Studies

Case Study: Risilience

Case Study: University of Bristol

The University of Bristol’s Payroll and Pensions team, overseeing 10K+ staff and 3rd party payrolls, sought interim leadership for successful and compliant operations, team management, and improvement plan development amid the Head’s departure.

Case Study: Newton Waterproofing Systems Ltd

Newtons Waterproofing Systems Ltd wanted to know if the services being delivered by their current IT Managed Service Provider were the correct services for their current and future business and if they deliver value for money.

Case Study: Inventor E

Case Study: Procomm Site Services

Case Study: Harrow Council

Case Study: Creative Folks

Case Study: Coventry and Rugby GP Alliance

Case Study: PSE Offline Marketing

PSE Offline Marketing wanted an independent review to assess their current systems and processes to identify risks and efficiencies but also to advise of any wider opportunities that could be exploited to improve their service offerings.

Case Study: The Wave

Opening in 2019, and having experienced a post Covid period of rapid growth and innovation The Wave wanted an independent review to assess their current systems and processes to identify risks and efficiencies but also to advise of any wider opportunities that could be exploited compared to best practice.

Case Study: Inventor-e

Ballards LLP worked in partnership with Enable. Services to implement the SugarCRM system in Inventor-e, a UK based provider of supply chain solutions. The main challenge was to maintain ongoing operations while transitioning to a new system, requiring a deep understanding of each department’s unique tasks and processes.

Case Study: Office Move

A leading UK professional services firm faced challenges such as limited capacity, outdated facilities, and escalating costs in its existing office space. Recognising the need for change, they engaged our project management services to orchestrate a smooth office relocation.

Case Study: Ashton and Moore Ltd

As one team, Creative Folks and the Ballards LLP Digital Transformation project management team were commissioned to rejuvenate Ashton and Moore Ltd.’s brand identity and digital presence as they celebrated

a century of business heritage.