Property Watch – January 2024 UK residential property transactions

The graph below shows the UK housing market transactions for the year to 31 January 2024 with comparatives for the same period to January 2023, as reported by HMRC through Stamp Duty Land Tax (SDLT) and Scottish/Welsh equivalent reporting.

* November 2023 to January 2024 figures are provisional due to delays in collecting all relevant SDLT/LTT/LBTT reporting.

The graph above shows:

- The January 2024 residential property transactions amounted to 68,090 transactions which were 10.0% down from January 2023 and 19.9% down from December 2023.

- Not shown in the above graph, but the January 2024 transactions were lower than the January 2020 (pre COVID) transactions by 15,750 transactions (18.8% lower).

- The Bank of England base rate remained at 5.25% throughout January 2024 (3.50% in January 2023).

- The transactions split by location in January 2024 was as follows:

| No. | % | |

| England | 57,370 | 84.3% |

| Scotland | 6,360 | 9.3% |

| Wales | 2,810 | 4.1% |

| Northern Ireland | 1,550 | 2.3% |

| 68,090 | 100.0% |

Key points to note:

- The December 2023 transactions in the above graph are 790 lower than those reported in our December 2023 issue of this circular (which can be viewed here: Property Watch –December) this is as a result of more data being collected throughout the last month to support the transaction data reported.

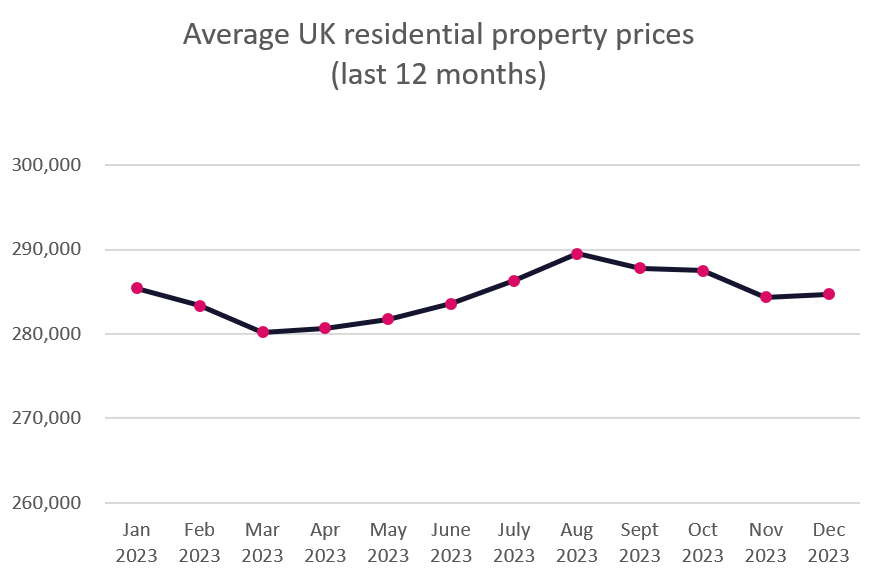

UK residential property transaction prices to December 2023

The latest residential price data, as provided by HM Land Registry to December 2023 (so a month out of sync with the transaction data above) shows that prices were 1.4% down at an average price of £284,691 compared to December 2022’s average of £288,744.

Residential property prices are 14.8% up from December 2020 (during COVID) where the average was £247,983 per the Land Registry data.

Property prices in December 2023 experienced a slight increase (0.1% increase) compared to the previous month November 2023’s average price of £284,321.

The graphs below show the change in average residential property transaction values over the past four years and the monthly change in the year to December 2023.

Please note that the above data and trends may not be consistent with published data from other data collectors such as property sites (Rightmove etc.) or the banks and the data is liable to change as the Land Registry receives additional market information.

Ballards LLP’s property team has extensive experience acting for property related businesses and can assist investors, developers and associated trades with all financial property matters including; tax efficient structuring, SDLT planning, Annual Tax on Enveloped Dwellings planning and reporting, and any other financial matters associated with property ownership. We act for all sizes of business.

If you would like to find out how we can help please contact Martin Adams, Tax Partner, at martin.adams@ballardsllp.com or on 01905 794 504.

To view past editions of this circular and other topical tax and business insights please visit our insights page.

Chi Duong, a Tax Associate at Ballards LLP, assisted in the preparation of this article.

Contains HM Revenue & Customs © Crown copyright data.

Contains HM Land Registry data © Crown copyright and database right 2020. This data is licensed under the Open Government Licence v3.0.

Disclaimer. This article has been prepared for information purposes only. Formal professional advice is strongly recommended before making decisions on the topics discussed in this release. No responsibility for any loss to any person acting, or not acting, as a result of this release can be accepted by us, or any person affiliated to us.