Insights

Deeper thinking

Uncover the latest tax insights from our expert team, designed to help your business stay informed and ahead.

Employee Ownership Trusts (EOTs) have gained attention and popularity as a means of promoting employee ownership, fostering a positive work environment, and offering a tax-efficient exit option for existing shareholders.

In this insight, we will examine key aspects and significant considerations related to EOT ownership structures.

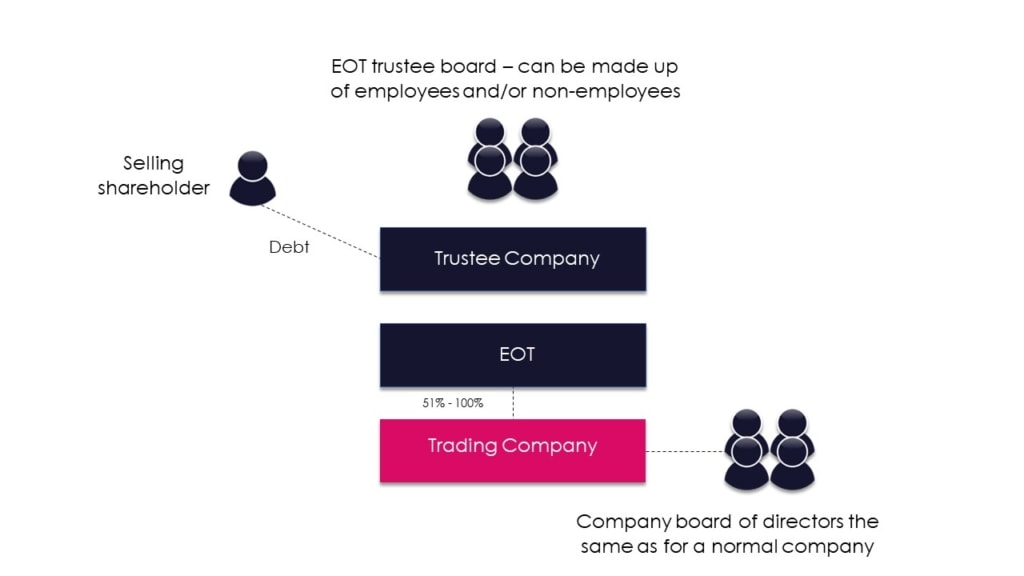

EOTs are established to hold shares for the benefit of employees, providing them with an indirect stake in the company’s success. Under the EOT structure, the trustees of a specially designed trust become the legal owner of the shares, and the qualifying employees of the company become the beneficiaries of the trust.

So long as the qualifying criteria applicable to EOT-owned companies are adhered to then a sale of a controlling share interest from individuals to an EOT will be tax-free for the selling parties. To retain the tax-free treatment certain criteria need to be met indefinitely following the sale of the shares.

Typically, the EOT will not receive dividends but if there are minority shareholders EOTs can be structured so those minority holders can receive dividends, subject to the normal approval processes.

Employees of an EOT-controlled company can receive up to £3,600 in tax-free bonus payments, such bonuses must be paid to all employees and meet certain qualifying criteria.

The above provides a quick insight into the benefits of adopting an EOT structure, there are a lot of other considerations to take into account together with rigid qualifying criteria.

If you would like to find out how we can help implement an EOT transaction, to include an initial free qualification assessment, please get in touch with Martin Adams at martin.adams@ballardsllp.com or on 01905 975 614 (direct dial).

Disclaimer. This article has been prepared for information purposes only. Formal professional advice is strongly recommended before making decisions on the topics discussed in this release. No responsibility for any loss to any person acting, or not acting, as a result of this release can be accepted by us, or any person affiliated with us.

Uncover the latest tax insights from our expert team, designed to help your business stay informed and ahead.